The federal government’s plan to temporarily stop collection of the goods and services tax (GST) on some consumer products is causing some big holiday headaches for Canada’s small business owners.

The tax break, expected to pass in the House of Commons, would take effect on Dec. 14, 2024 and last until Feb. 15, 2025.

It would apply to dozens of items, including certain groceries, alcoholic beverages, restaurant meals, snacks, children’s clothing and toys, car seats, books, print newspapers, puzzles and Christmas trees.

But small business owners who spoke to Global News, describe the plan as “an IT nightmare.”

“We’re coming into the busiest time of the year. We see a huge retail spike in sales. So we’re busy doing a lot of things”, says Yousef Traya the owner of Bridgeland Market.

“Now we have to pivot to figure out what to do with this new GST mandate. It’s great. We want people to save money. It’s awesome. But on the backend, on a small business like us, the amount of money we have to spend just to implement this is not great,” said Traya who adds, despite the plan’s good intentions, it will cost him thousands of dollars to implement, especially on such short notice.

“It is time consuming. It’s a lot of accounting on the backend and figuring out like what doesn’t have GST and what still does. That’s a big problem.”

The owner of The Sentry Store, a Calgary gaming store, says implementing a temporary GST holiday on some consumer products ‘will be hell’ so he’s planning to reduce the GST to zero per cent if the federal government’s plan goes ahead.

Global News

Gordon Johansen, owner of a gaming store called The Sentry Box, says for some places “it will be hell.”

Not only is it an accounting nightmare, but he also expects huge lineups at the cash register as retailers take the time to figure out which products are affected and which ones aren’t.

Johansen said he and other retailers have been trying unsuccessfully to get answers but the Canada Revenue Agency (CRA) “can’t tell us squat.”

So Johansen says he’s come up with his own plan. If the tax break happens, he’s decided “forget it. We’ve got 85,000 different items in stock. We’ll charge a blanket GST rate of zero per cent,” added Johansen.

“The staff are very, very happy that we’ve just put this in place because we can do that with our computer system. But a lot of places can’t,” Johansen said.

The Canadian Federation of Independent Businesses says a recent survey showed a majority of small firms oppose the planned GST/HST holiday and that increases to 62 per cent among those required to implement it.

The CFIB is urging the federal government to give affected small businesses a credit of at least $1000 in their GST/HST accounts to cover the costs of implementing the tax break.

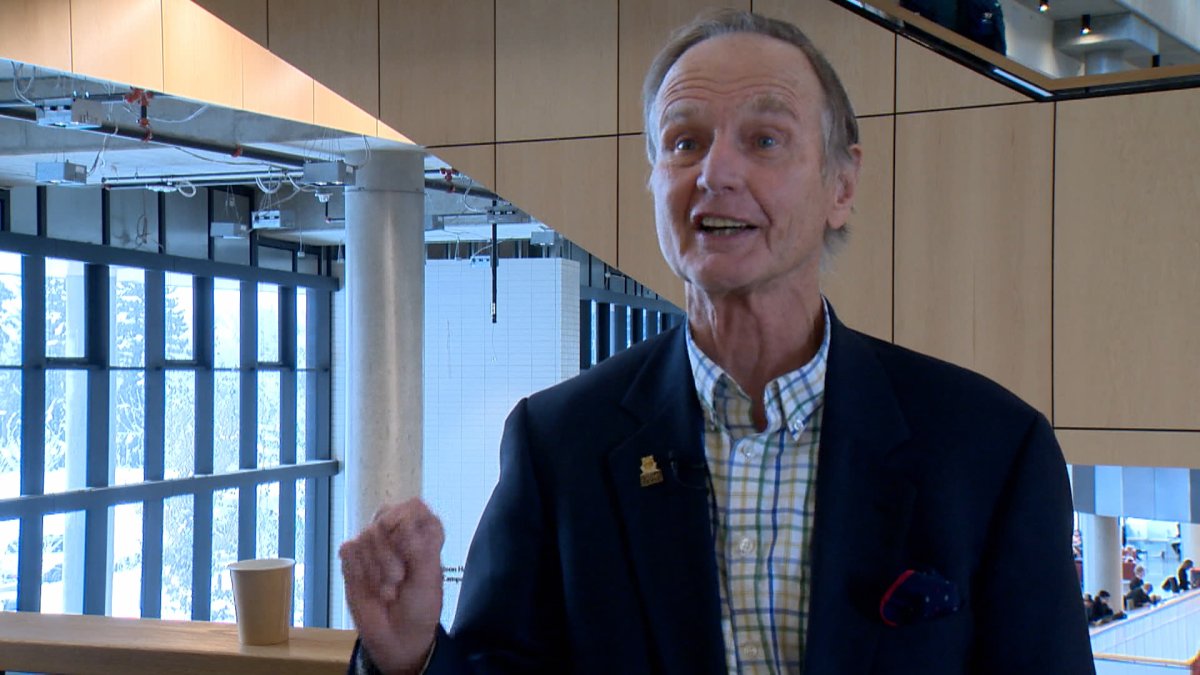

Tom Keenan, a professor at the University of Calgary said the GST holiday “could be either very simple or really, really complicated for a business.”

“If you are on Shopify, they’re going to do it all for you. They’re going to put in all the codes and figure things out.”

But “if your cousin built your IT system, you’re going to get your cousin back to make a lot of changes because every product has to be identified to see whether it’s in or out,” added Keenan.

University of Calgary professor Tom Keenan says the federal government’s plan for a temporary GST holiday was really not well thought through.

Global News

The federal Liberals say the “GST holiday” will offer relief to families struggling to make ends meet and comes at a time when inflation has also slowed down.

It estimates someone spending $2,000 on such items over the two-month period will save between $100 and $260.

But Keenan said “it really wasn’t well thought through, because not only do you have to make changes to your point of sale system. What about your website? What about training your employees? People are going out and seeing their tax accountant and those boys and girls aren’t cheap. Right.”