The top executives at Canada’s big three grocers are set for questioning from members of Parliament on Wednesday afternoon as Canadian households continue to deal with food inflation.

The CEOs and presidents of Loblaw Cos. Ltd., Metro Inc. and Empire Co. Ltd. — which operates chains including Sobeys, Safeway and FreshCo — are set to testify before the House of Commons agriculture committee at 4:30 p.m. ET as part of its study on food inflation.

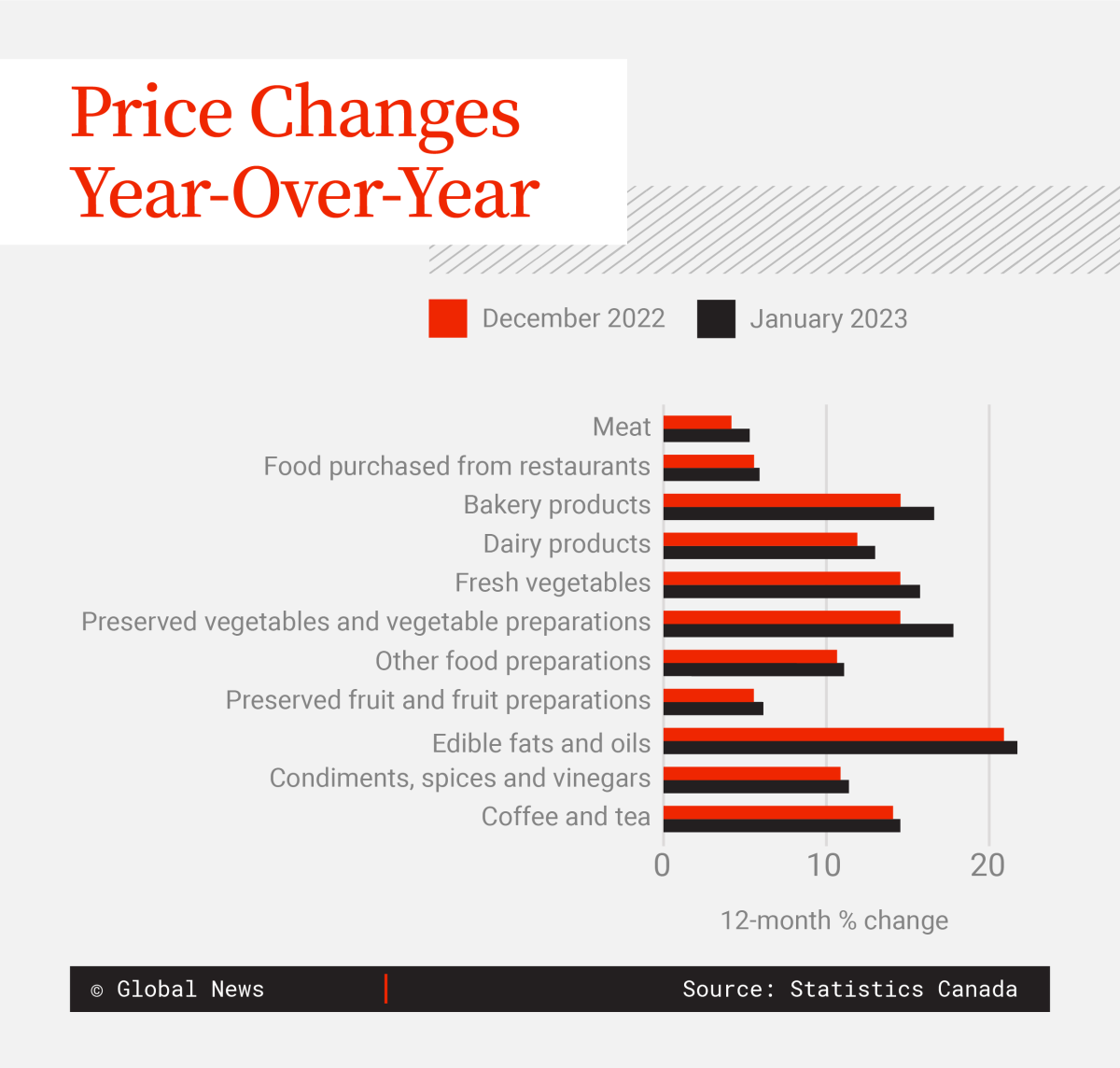

While headline inflation has shown signs of cooling in recent months, prices for food purchased from the grocery store was again up 11.4 per cent in January, according to Statistics Canada.

Read more:

Inflation seems to be cooling — except at the grocery store. What’s going on?

Grocers themselves have been increasingly under fire for the prices of the food on their shelves.

Among those MPs expected to attend is NDP Leader Jagmeet Singh, who has accused the grocery giants of price-gouging Canadians en route to higher profits in 2022.

An analysis from Dalhousie University’s Agri-Food Analytics Lab published in November found all three top grocers beat their five-year averages for profit in the first half of 2022, with Loblaw beating its previous best results for the period by $180 million.

But the grocers have defended their profits, saying their margins haven’t changed.

Loblaw acknowledged in a recent social media campaign that it had become the “face of food inflation,” but stopped short of taking the blame for soaring prices. The chief financial officer for the country’s largest grocer said recently that the company is “not taking advantage” of food inflation to drive profit.

Simon Somogyi, the Arrell Chair in the Business of Food at the University of Guelph, tells Global News that the grocery CEOs’ appearance at committee on Wednesday is an “opportunity” for those on both sides of the questions.

MPs will have the chance to represent the struggles of everyday Canadians, Somogyi says.

High prices at the grocery store are just one set of pressures pushing Canadian household finances to their limits.

Data from Statistics Canada released on Tuesday showed that just 29 per cent of Canadians felt they lived in a household where they could easily make ends meet by the end of last year — down from nearly half (48 per cent) in mid-2021.

“That’s the role of the various politicians who will be there to quiz (the CEOs) — to have the best interests of all Canadians at heart and to be a little tough on them and so that they can understand the pain that is going on,” Somogyi says.

Digging into grocers’ financials

Wednesday’s committee also offers MPs a chance to dig into grocers’ financial statements for a clearer understanding of how much profit retailers are drawing from higher prices on food.

Somogyi says that while grocers’ overall profit margins as of late have floated between four and six per cent, it’s not clear how much of that comes from the sale of food as opposed to other high-margin goods such as cosmetics, over-the-counter drugs or clothing.

David Macdonald, a senior economist at the Canadian Centre for Policy Alternatives, said the grocers may indeed be making their profits off of non-food products. But “we have no way to evaluate that because we can’t see any of that segmented information,” he told the Canadian Press.

And even if profits are being driven by lipstick or soap sales, Macdonald said that shouldn’t necessarily insulate the companies from scrutiny.

Corporate profits shot up significantly in 2021 and 2022, coinciding with the global rise in inflation and fuelling accusations of “greedflation.” That across-the-board trend deserves more attention, Macdonald said.

As Canadians meanwhile face soaring prices on meat, pasta, milk and other staples, grocers should be transparent about how much money they make on these sales, Somogyi argues.

Many food categories say prices accelerate from December.

“That information isn’t readily available,” Somogyi says. “As those are the things that most consumers buy, I think it’s fair that we have some understanding of exactly how much profit there is.”

Similarly, however, grocers will have a chance on Wednesday to make clear how their prices are being impacted by higher costs through the supply chain, Somogyi adds.

Loblaw executives argued that inflation had hurt, not helped, the grocer’s profit margins during an earnings call last month.

Read more:

Loblaw is ‘not taking advantage’ of food inflation to drive profits, CFO says

Loblaw CEO Galen Weston Jr. said then the company is still getting “thousands” of requests from suppliers for “significant cost increases” despite some recent relief on price pressures at various points in the supply chain.

Somogyi says it will be up to both MPs and the CEOs to communicate how these global pressures are affecting Canadians’ grocery bills.

“We see all these costs across the food supply chain going up, but we have very little understanding of exactly how that impacts the dollar that you spend in the grocery store.”

What will finally bring grocery prices down?

There are a few concrete measures Somogyi says he’d like to see coming out of Wednesday’s committee meeting.

First would be an update on a possible grocer’s code of conduct in Canada, which has been talked about at length with little indication of progress. He says he’d like to see an updated timeline on when this could be introduced and what it would include.

The best outcome would be measures to improve competition in Canada’s grocery sector, making the industry more welcoming for disruptive competitors such as Europe-based Aldi or Lidl.

U.S. grocery chains typically post profit margins closer to two per cent — roughly half what their Canadian counterparts report — according to Somogyi. He says this reflects a more competitive landscape south of the border.

A recent Senate of Canada report probing the long-term causes of inflation identified the need to increase competition in numerous sectors as a possible route to limit price pressures in the future.

In October, the Competition Bureau announced it is undertaking a study that will specifically look at whether competition in the grocery sector is playing a role in the higher prices.

Macdonald said MPs could ask the grocery CEOs whether they will commit to providing full access to their financial records to the Competition Bureau as it embarks on its study.

Without such commitments, the bureau’s powers are “very limited,” he said. “They can’t compel any additional information.”

A final report is expected in June, complete with recommendations for the federal government.

Until then, the outlook for food prices isn’t good, Somogyi notes.

The 2023 price report from Somogyi and his peers projected another five-to-seven per cent hike in food inflation this year, with hopes of easing by the summer and fall months.

But he also warns that the grocery CEOs’ committee appearance might not be the most significant event on Wednesday to influence the future of food prices.

Read more:

These economic ‘wildcards’ might keep inflation higher for longer

The Bank of Canada is set to make another decision on whether to raise its benchmark interest rate that same day, with most economists expecting a pause even as the U.S. Federal Reserve warns its rates might need to rise higher.

Somogyi says that if the central bank is not as aggressive with rate hikes as its U.S. counterpart, the Canadian dollar might tumble as a result — driving up import costs on food from the United States and Mexico at a time when grocers rely on inputs from warmer climates.

He says the roadmap for the central bank’s interest rate decisions in 2023 will have a significant impact on how much Canadians are paying at the grocery store this year.

“It’s going to be a rocky road,” Somogyi says.

— with files from The Canadian Press